Intern report (3/4):SSE (Social solidarity Economy) –its characteristics and challenges

------------------------------------------------------------------------------

This report introduces what the Social Solidarity Economy (SSE) is, the challenges it faces and why the ILO works on the SSE. At the end of the report, I conclude with my own ideas and suggestions about the role of the SSE in the future.

Please check out previous posts at the following links.

Vol.1 SSE : Social Solidarity Economy

Vol.2 ILO and SSE ~How the ILO deals with the SSE

------------------------------------------------------------------------------

3.Challenges SSE faces

Cooperatives and SSE are contributing to promotion of Decent Work, however, there are some challenges they face because of their characteristics. These challenges make cooperatives and SSE difficult to scale up.

1) Balancing economies of scale and democratic governance

Geographical restrictions on where cooperatives can operate is one of the institutional barriers for cooperatives to scale. In Japan, cooperatives are restricted their business in one prefecture basically. In India, cooperatives can run their business only in one state practically because the law regulating cooperatives are different from state to state. Therefore, federal organizations are usually established to connect each regional cooperatives. In Japan, Kokumin Kyosai Co-op has member cooperatives from 47 prefectures. In India, SEWA has federal organization named Gujarat State Women’s SEWA Cooperative Federation Limited which has 115 member cooperatives. These federal organizations represent members’ interest in national and international fields, build capacity of member cooperatives and connect members.

Though these geographical restrictions are put by the government, It is reasonable for cooperatives because they are expected to meet the needs of communities and create decent work for local people. However, it may not be appropriate when memberships get diverse due to digitalization or where scale is important such as financial services.

What’s more, even if cooperatives scale, the characteristic of governance of cooperatives: democracy, one vote per person, may be weakened due to lack of feeling of solidarity. UNTFSSE[1] also recognizes this problem and points out that large cooperatives tend to have hierarchical governance structure and prioritize efficiency rather than equity, making it difficult to differentiate cooperatives from CSR of enterprises. For example, the Tokyo university coop, one of the sites I visited last year as a tour, showed their concern about its decreasing membership and solidarity.

I think it is difficult for new members to recognize their membership and their capacity to influence decision making of existing cooperatives while it may easier for founding members of new cooperatives. One of the causes is thought to be lack of information about characteristics and benefits of cooperatives.

2) Finance

Raising funds is another challenge cooperatives and SSE face. Stable finance is necessary for them to scale and keep their business under volatile markets.

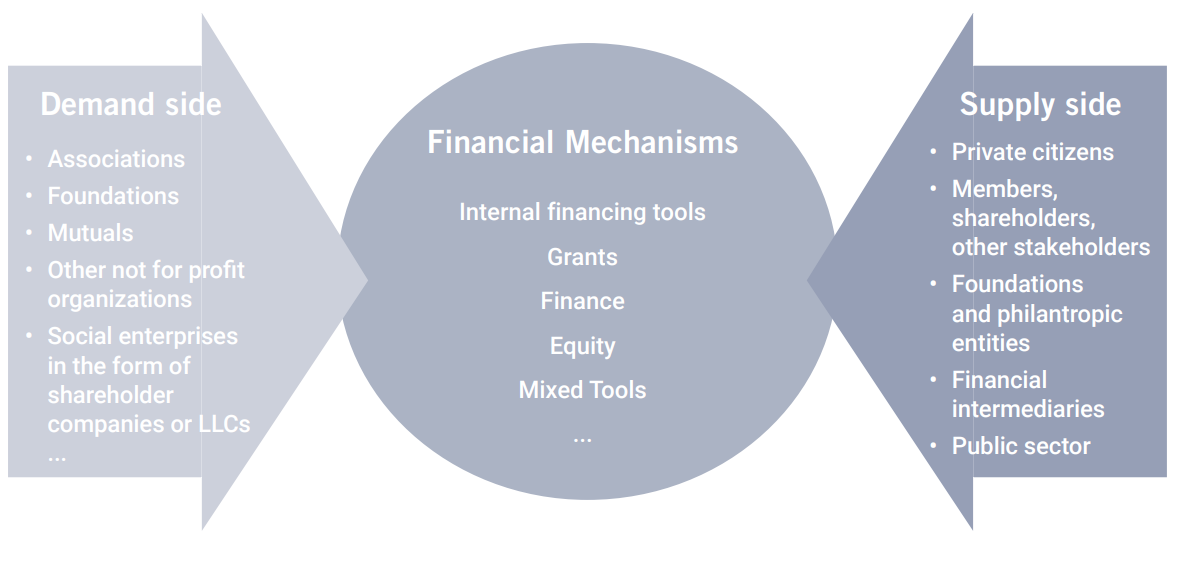

SSE usually procures its funds through using internal resources, charity and donation, loan and equity. Figure shows SSE uses the same means to raise funds as commercial enterprises and unique ones to SSE. For example, Corporacion Mondragon in Spain (federal organization for workers’ coop) faced a bankruptcy of its member cooperative, which manufactured home appliances, in Financial Crisis in 2008[2]. Mondragon holds 266 subsidiaries which include not only cooperatives but also companies. Despite the diversification of risks and large size of the group, Mondragon could not keep funding to its member using its internal funds [3], causing bankruptcy and large losses of employment in the end. The challenges behind these procurements is the difficulty of estimating SSE’s financial needs, social value and risks appropriately. Therefore, financing to SSE is not so much different from finance to commercial companies, however, building guarantee scheme of SSE is recommended. This scheme is provided by public funds and credit consortia formed by SMEs and cooperatives on the principles of mutuality and solidarity[4]. They guarantee SSE’s credibility to financial institution with some form of guarantee funds.

[1] UNTFSSE(2018) op.cit

[2] Hisashi Sakauchi (2014) “The Mondragon cooperative in Spain-a detail of bankruptcy of FAGOR and its correspondence-” Norinkinyu, July

------------------------------------------------------------------------------------

Final article is about possible solutions & the future roles of the SSE.

Please check the article at:

labourstandard1919.hatenablog.com